Substantial Presence Test Calculator 2025. The internal revenue service (irs) substantial presence test is the united states government’s standard for determining how much taxes you are to pay based on. Using the substantial presence test, we calculate her days as follows:

The substantial presence test is a simple calculation that establishes whether or not the irs considers you to be a resident or nonresident alien for tax.

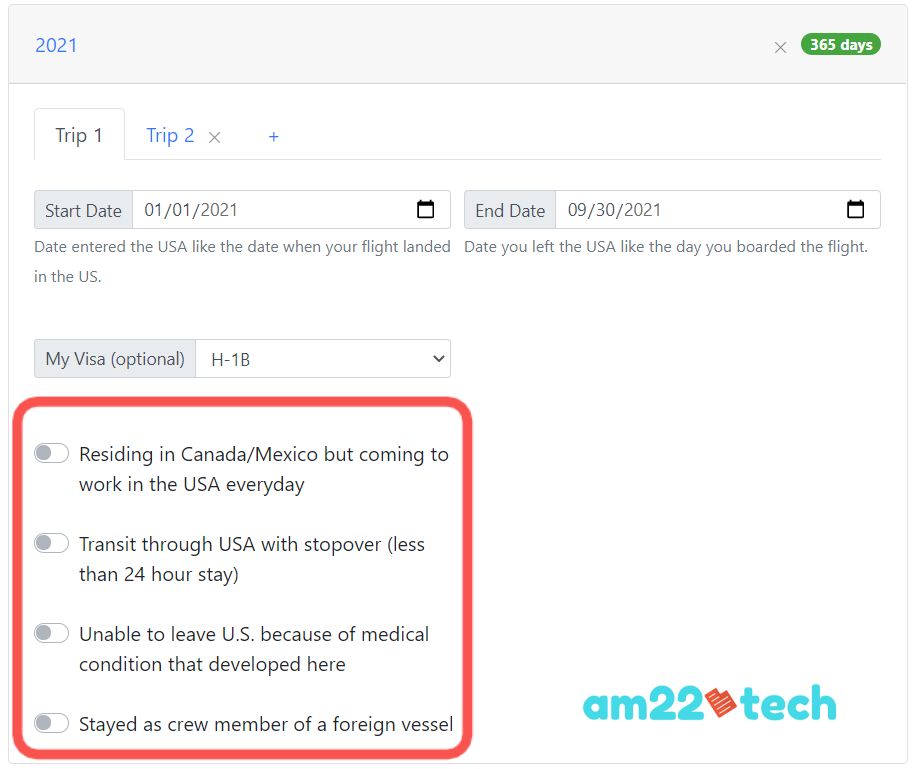

The following are examples of the application of the tax residency rules to various situations involving visitors to the united states and individuals temporarily present in the united.

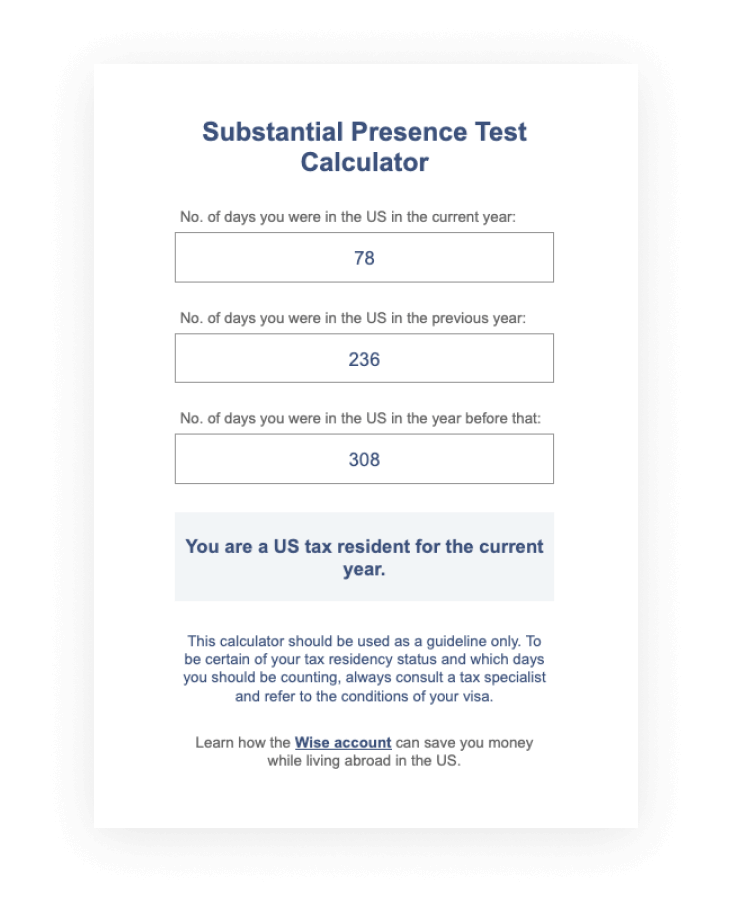

Substantial Presence Test Calculator Wise, The substantial presence test is a simple calculation that establishes whether or not the irs considers you to be a resident or nonresident alien for tax. For tax year 2025 ( to be filed by april 2025 ), you would probably qualify for the substantial presence test and there may have to file on form 1040 using turbotax.

substantial presence test calculator Internal Revenue Code Simplified, In order to calculate if you meet the substantial presence test, use the calculator below. Citizens and assesses whether they have spent a sufficient amount of time in the united states to be treated as a resident for tax purposes.

Substantial Presence Test How to Calculate YouTube, The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2025. Citizens and assesses whether they have spent a sufficient amount of time in the united states to be treated as a resident for tax purposes.

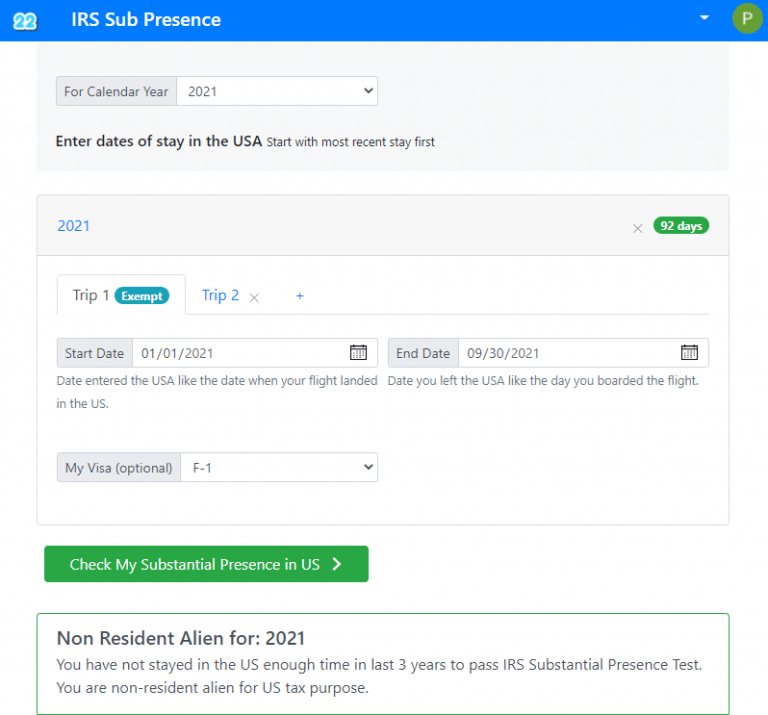

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech, Use the calculator to determine your eligibility under the substantial presence test by accurately tallying your days of presence in the u.s. The substantial presence test (spt) determines whether a canadian will be considered a us tax resident by the irs.

Substantial Presence Test Finance and Treasury, Candidates who are currently studying in the 3rd or higher years. That is, whether you are a.

Substantial Presence Test Finance and Treasury, 31 days during the current tax year you are. 120 days (current year) + 20 days (1/3 of 60 days in 2025) + 5 days (1/6 of 30.

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech, Substantial presence test calculation (spt) the substantial presence test is a sneaky way for the us government to require foreign nationals to pay u.s. This calculator is for educational purposes only and should not be used for tax.

Substantial Presence Test for U.S. Tax Purposes What Are the Basics, It is designed for individuals, business owners, and tax professionals. The substantial presence test is a simple calculation that establishes whether or not the irs considers you to be a resident or nonresident alien for tax.

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech, 120 days (current year) + 20 days (1/3 of 60 days in 2025) + 5 days (1/6 of 30. Under the internal revenue code, your tax liability depends primarily on one fact.

Easy Substantial presence test calculator, The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2025. 31 days during the current tax year you are.

The substantial presence test is a simple calculation that establishes whether or not the irs considers you to be a resident or nonresident alien for tax.